Pitching investors is one of the most challenging things in being an entrepreneur.

Actually, it’s not…

You might think it is, if (1) your company is not prepared to raise money or (2) you are not prepared enough to pitch investors.

Let’s focus on #2, the investor pitch.

Here’s some good news:

You don’t need to be an amazing public speaker to impress investors. If you follow the advice from this article, you’ll get a real advantage.

But… you also need to practice as much as you can. Knowing is nice. Taking action is what makes a difference.

The 10 Principles for a Good Investor Pitch

Before diving into creating your pitch deck, there are few principles you must have in mind.

Based on my experience pitching multiple times (for GoudronBlanc and Blackwood), investing in startups myself, and digging into top business pitch advice, I condense my learning into the 10 Laws of Investor Pitch.

These 10 principles will help you improve the way you pitch your startup to investors, especially early-stage investors—i.e. business angels, incubators and accelerators, and seed-round venture capital firms.

LinkedIn’s Series B Investor Pitch (Including Slides)

I’m so grateful for what seasoned entrepreneurs have been doing recently.

Why?

More and more of them are sharing the backstage of their stories. And what happened behind the scene is actually part of the most valuable resources you can learn from.

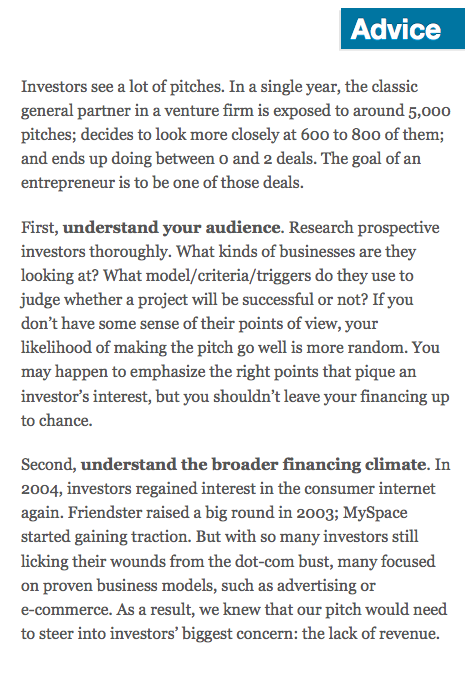

One of my favourite backstage stories is how Reid Hoffman pitched the venture capital firm Greylock Partners. Here’s the pitch deck that Reid Hoffman used to convince them to invest in LinkedIn’s Series B.

Besides the actual investor pitch, Reid Hoffman also gives some context and shares some insightful advice—based on his experience as an entrepreneur and as an investor.

Airbnb’s Investor Pitch Deck for Early Stage Fundraising

Another of my faves is Airbnb’s first pitch deck. Now that know how successful Airbnb has become. It’s very interesting to see that their pitch deck has nothing extraordinary. You can certainly do better.

10 slides. Concise and consistent.

Looking at the structure teaches a lot. Great food for thoughts!

Here are the 10 slides that Airbnb included in their pitch:

- Introduce your company

- Start with the problem.

- Explain the solution.

- Prove that people want your solution.

- Demonstrate that your market size matters.

- Show your product/MVP.

- Tell them how you make money.

- Present how you acquire new users.

- Highlight what is your position in the competition landscape.

- End on a good note with your ‘unfair’ competitive advantages.

The structure of the investor pitch deck is quite similar to what Sequoia recommends that founders do, except that Nathan Blecharczyk did not mention his team at all.

(Funny enough, this is the team and their imagination that made Y Combinator’s Paul Graham tick when he invested in Airbnb—not the initial idea for Airbnb.)

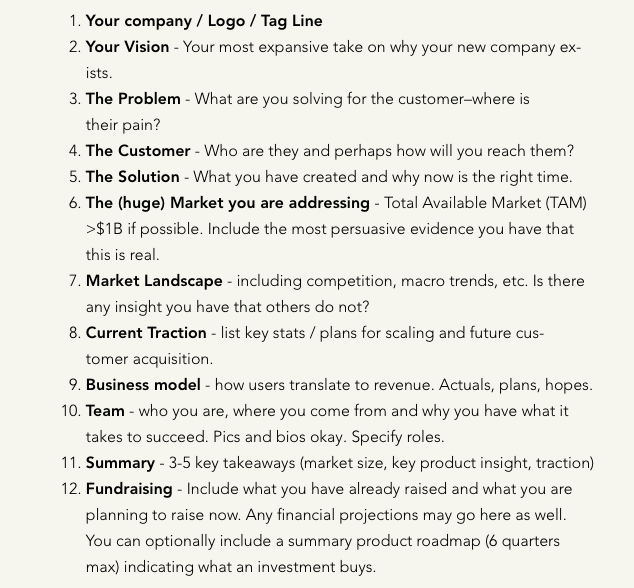

Y Combinator’s Template for Your Investor Pitch (Executive Summary + Slide Deck)

In an article about raising money for a seed round, Y Combinator shares some advice about what you should include in an executive summary:

“The executive summary should be one or two pages (one is better) and should include vision, product, team (location, contact info), traction, market size, and minimum financials (revenue, if any, and fundraising prior and current).”

Regarding the slide deck, avoid too many words. Focus on sharing visual information: graphics, charts, screenshots… The words will come from your mouth, not from your slides.

Here’s a structure that the Y Combinator team suggests:

It’s a great framework. And you’ll see below 500 Startups suggests something quite similar.

It gives you the necessary constraint to make sure you focus on what matters. But it’s also wide enough to make your story fit into it.

Dave McClure’s Structure to Build a Strong Business Pitch Deck

500 Startups’ recipe to an awesome investor pitch is quite similar to what Airbnb did. Dave McClure highlights that you should start pitching ‘my problem’ and not ‘your solution’.

- Elevator Pitch (Teaser Image Goes Here)

- The Problem

- Your Solution (Demo Goes Here)

- Market Size

- Business Model ($)

- Proprietary Tech

- Competition

- Marketing Plan

- Team / Hires

- Money / Milestones

As Andrea Barrica, a partner at 500 Startups, mentioned:

A memorable startup pitch is “an exercise in empathy and storytelling,” not salesmanship.

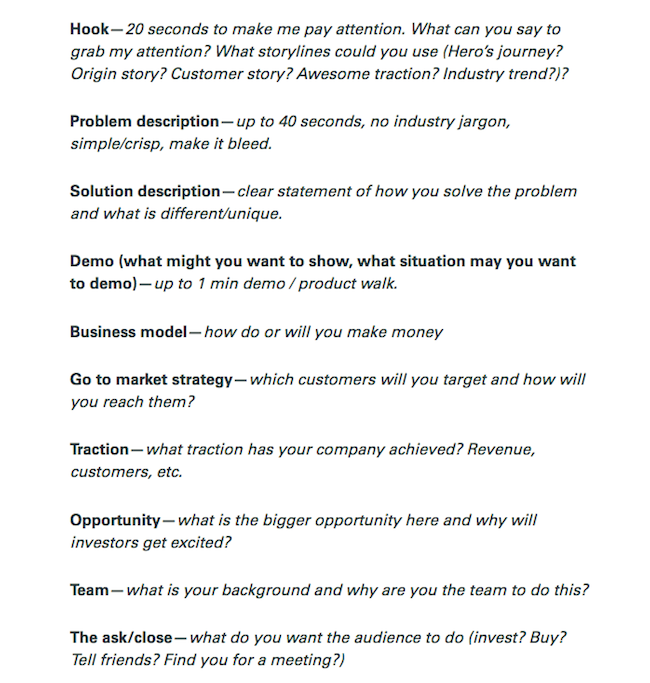

TechStars’s Secret Sauce for Creating a Great Pitch

TechStars does a great job at teaching startup founders how to pitch to investors. TechStars Demo Days prove that it’s possible to get investors interested in the great potential of your business in two minutes.

Telling a surprising, unexpected story contributes a lot to getting investors on board. Here’s what Wesley Eames, a TechStars alumnus, recommends:

“An investor once told me his favourite thing about a pitch is when he thinks he knows exactly where it’s headed, but is then surprised by something the entrepreneur says or does. He said, ‘You are truly excited about something you normally don’t care about, and you want to give the person your money because they just changed you, or convinced you to change your mindset.’ What this investor is saying is, you have to be very deliberate about your presentation. Instead of relying on industry facts and jargon, tell a compelling and surprising story.”

And there’s a structure that can guide you:

But don’t forget that the structure is just a starting point.

Two things will help you create a great investor pitch:

- Helping investors to relate to the problem your target market has

- Allowing them to see the bigger opportunity (how your business can scale)

If you want a good way to express the customer problem, have a look at The Value Mix.

Make Your Investor Pitch Deck More Emotional

Don’t only focus on numbers. Investors should buy your story and their judgement is not only based on the figures you are showing, especially if you are running an early-stage startup.

Don’t only focus on numbers. Investors should buy your story and their judgement is not only based on the figures you are showing, especially if you are running an early-stage startup.

Here is a piece of advice from Seth Godin an eBook titled Really Bad PowerPoint (and how to avoid it). Communication is the transfer of emotion:

“If all you want to do is create a file of facts and figures, then cancel the meeting and send in a report. Do it in PowerPoint if you want, but it’s not a presentation, it’s a report. It will contain whatever you write down, but don’t imagine for a second that you’re powerfully communicating any ideas. Communication is about getting others to adopt your point of view, to help them understand why you’re excited (or sad, or optimistic or whatever else you are.)

The three tasks that most people set out for a PowerPoint are in direct conflict with what a great presentation should do. Our brains have two sides. The right side is emotional, musical and moody. The left side is focused on dexterity, facts and hard data.

When you show up to give a presentation, people want to use both parts of their brain. So they use the right side to judge the way you talk, the way you dress and your body language. Often, people come to a conclusion about your presentation by the time you’re on the second slide. After that, it’s often too late for your bullet points to do you much good.”

Definition: Investor pitch vs. Elevator pitch

The investor pitch is one of the many formats for presenting your startup to potential investors. It takes place at the venture capital firm’s office and lasts for 15 to 45 min. Having a slide deck to illustrate your presentation is recommended.

A pitching competition or a demo day allows you to speak to a group of investors for 2 to 5 min. You’re often allowed to have a slide deck to support your presentation. As the time allocated to speak is short, I recommend that you memorise your pitch.

An elevator pitch is an opportunity to explain the problem you’re solving and your value proposition to someone you just met. The name reflects the idea that you should be able to summarise what your business does in the time span of an elevator ride (roughly 30 sec to 2 min). You should know exactly what you’re going to say.

(Here are a few pitch decks from companies like Buffer, Intercom, WeWork…)